Our website may use cookies. By using our website, it tells us you are happy to receive cookies from us.

You can find out more in our cookie policy.

Scottish Power were concerned that their employees weren’t saving enough toward their pension, and didn’t understand how much they might need for a decent income in retirement.

The majority of Scottish Power employees work off site so it’s difficult to reach them. As the role is physically demanding, the option of working for longer to secure a comfortable retirement is often not an ideal option.

Scottish Power was keen to engage its employees about their long term saving and provide guidance to give them a clear understanding of whether they were on track to retire at the age and on the income they wanted. They also wanted to help them understand the actions they could take if their retirement planning was off track.

Scottish Power already suspected that most employees were not making the most of employer matching contributions. However, an analysis of the member data was carried out by Hymans Robertson which confirmed that a significant number of employees weren’t on track to achieve an adequate income at retirement.

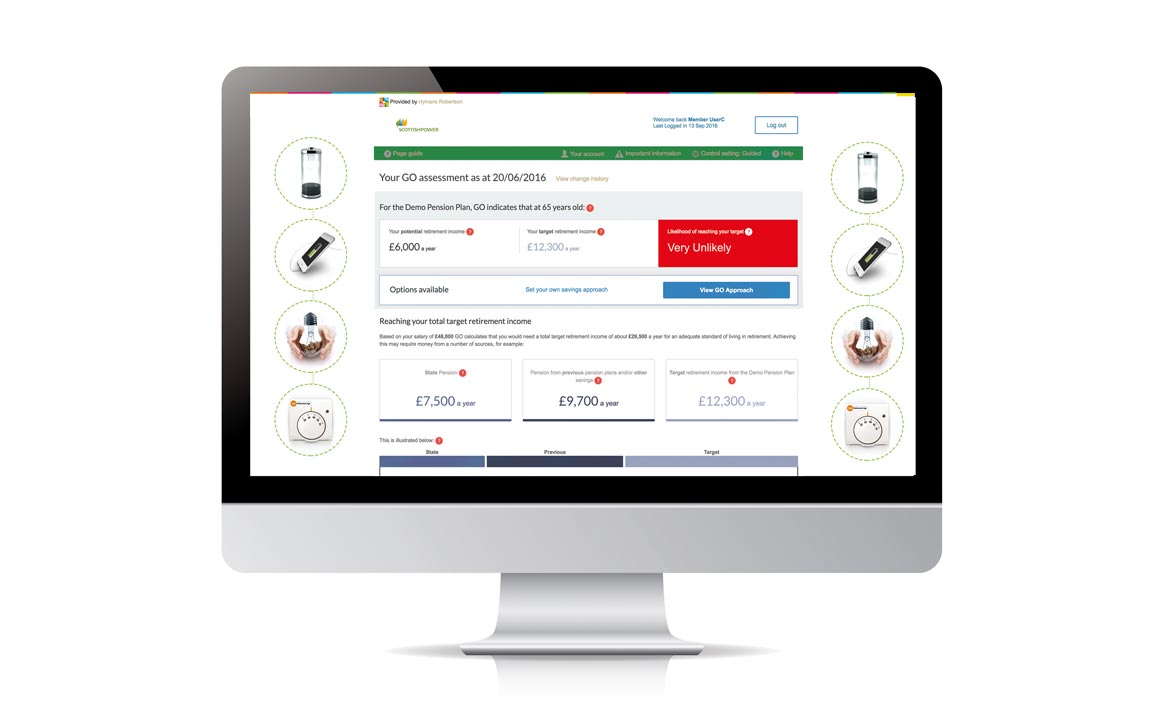

As a result Scottish Power introduced Hymans Robertson’s GO portal for members. The portal calculates individual members’ pensions savings as green, amber or red in terms of likelihood of achieving a suitable retirement income.

Working with the Pensions Manager, like minds developed a communication strategy that would help employees to engage with this information. We also liaised with HR to ensure that they understood the work we were doing and would be in a position to provide support for member queries.

We produced a warm up teaser campaign including posters and flyers followed by a personalised statement which told employees how much they needed for retirement and how much they were currently on track to receive.

We also designed the front end of the ‘GO portal’. This included a sliding tool which allowed employees to see the effect of different contribution levels and work out how much more they needed to pay in to their pension to retire at their intended retirement age, and work out how much longer they’d be willing to work (within the realms of the realistic!) to achieve their retirement income goals.

Scottish Power launched the GO portal in November 2015. The approach was immediately well received, with more than one-third of members logging on to the portal straight away.

In the first month after launch, Scottish Power saw 1 in 10 members increase their scheme contribution with many more changing their retirement age.

Our communication strategy for Scottish Power GO demonstrates that the ground-breaking work we do can change the way that people think about their pensions. Members are now much better informed about how much money they will need in retirement and how much they are likely to receive from the plan. Most importantly they are saving more than before.

“Our members have been delighted with GO – it has had a considerable impact on member engagement with our DC plan and has been instrumental in helping Scottish Power meet its DC objectives.”

Anne Harris UK Pensions Manager, Scottish Power